Can I Change My Car Loan Term Malaysia

In 1949 the loan tenure for a VW Beetle was 12 months with an interest rate of 9 per annum. Compare your car loan options.

Auto Loan Logo Images Browse 1 709 Stock Photos Vectors And Video Adobe Stock

Many people who change terms during an auto loan refinance choose to extend the term.

. The total cost just RM130. The 6-month moratorium simply means that your car loans tenure period will now be extended until July 2025. Lets say your car loans tenure period runs until January 2025.

You can also renew your car insurance and road tax via MYEG. Hi all LYN membersThe story is long so Im gonna cut it all short and go straight to the pointI decided to get a used car from a car dealerThe situation now is the car dealer has not deliver the car to me after I have signed the agreement for more than 2 weeks time not even the Puspakom inspection is done. At JPJ youll need to have the following things.

You can read up about the rule of 78 by doing your own research but be warned that you might get upset once you discover how some bank loans work. Vehicle registration number and IC. A small reduction in interest can amount to a lot of savings over several years.

There are many banks and finance companies that offer car loans in Malaysia. The deceaseds original death certificate. You can do so by calling 03 7801 8888 and you will be assisted.

If you are refinancing your auto loan there is a good chance you can change your auto loan term. The car loans that are available for foreigners require them to be accompanied with a local guarantor. Scenario 1 Tenure 7 years 84 months Interest rate per annum 3 Number of installment paid 30 months Early settlement penalty RM0 Using our car personal loan calculato r the early settlement amounts to RM34684 with a total rebate of RM4209.

In this example you select Maybank Hire Purchase to finance your car purchase. First get the car inspected by Puspakom and then head to JPJ. Yes this means that if you prepay at a later stage of the loan tenure there are not much interest savings because you would have paid up most of our interest portion by then.

Basically there is no process going on before and. The IC of the person in charge of handling the deceaseds matters. 18 20 depending on loan package Maximum Age.

You need these information ready. But in some circumstances the car dealer will call and tell you that the terms have changed and that you must go sign new paperwork. In Malaysia today car loan tenures are usually of 57 or even 9 years with interest rates hovering around 3 per annum calculated on principal.

JPJ K3A form this is different from the K3 form which is for voluntary transfers. After the paperwork has been signed and youve taken your new car home you may think that the terms of the loan you agreed to are locked in at least from your side of the deal. Assuming you have made full payments in the last 90 days you dont have to pay anything from April 2020 until September 2020.

Depending on the type of loan undertaken you may save money with early settlement. Whether or not you should do this is another matter. What car loan modification is As the name implies a car loan modification entails changing the terms of your loan.

Now the financial institutions get involved with the deal. By extending the duration of the auto loan you likely will lower your monthly car payment. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years.

Auto debits will also be paused. Individuals must be Malaysian citizens. 44 70 depending on loan package If youre looking for specific loan packages that fit your needs you should check out the vehicle financing options that Bank Muamalat offers.

Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter-tenured loans. To illustrate further see the car loan. If yes the bank can claim rights to the car and youll need to settle the loan first before you can transfer.

Lets use a RM50000 car loan with the following as an example. In Malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years. Because interest rates can differ between lenders it is worth spending some time researching and comparing the car loan interest rates of each bank.

The lender may agree to lower your interest rate defer your payments in the. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10. Once you have renewed your car insurance you can proceed to renew your road tax via MYEG at a JPJ branch or Post Office.

JPJ Malaysia FB However the process is more tedious when the buyer requires a loan to purchase your car. Here are things you should know about settling loans- You do not need to go to the home branch of your car loan to make full payment. Any salary earning individuals self-employed individuals public listed companies private limited companies sole proprietorships and partnerships can apply for a car loan.

RM30 for the inspection and RM100 for the ownership transfer.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

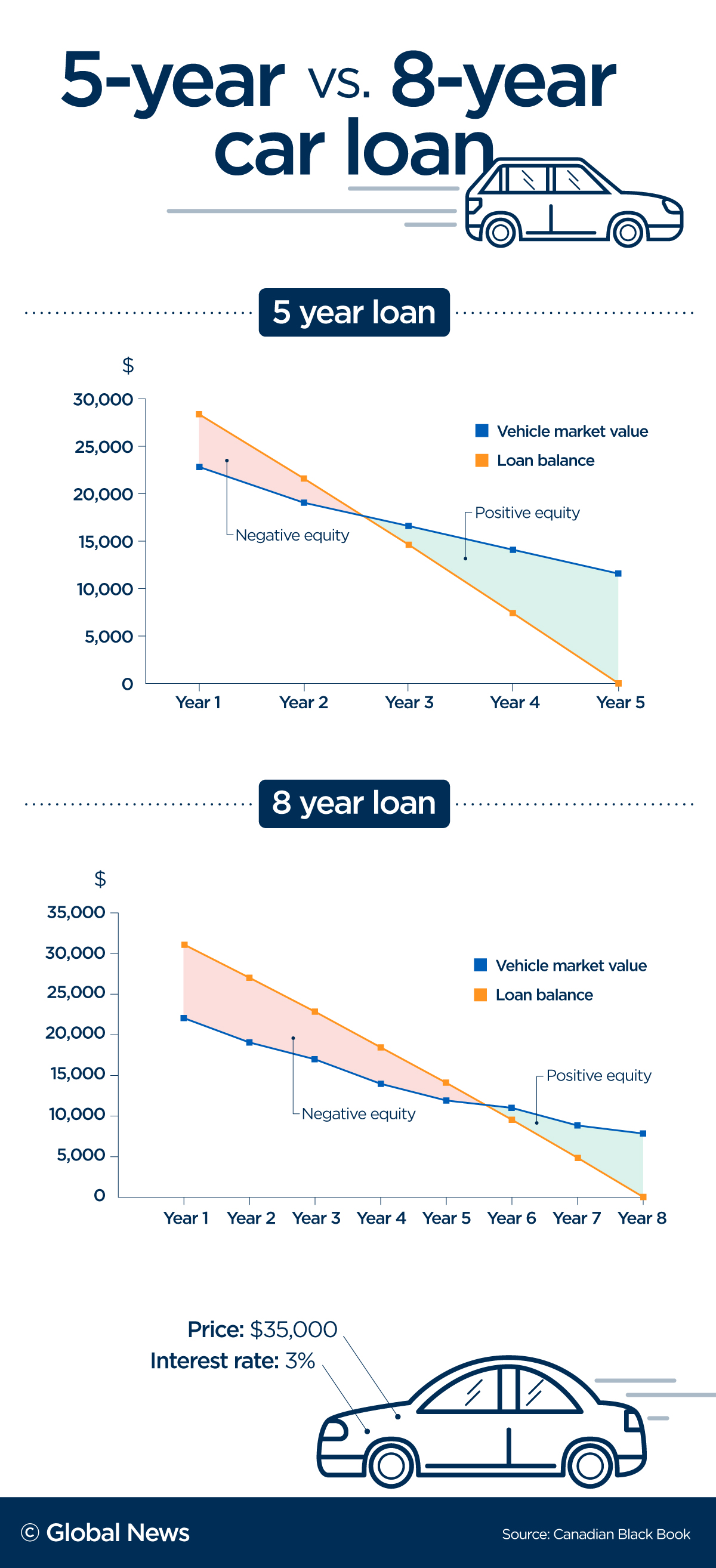

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

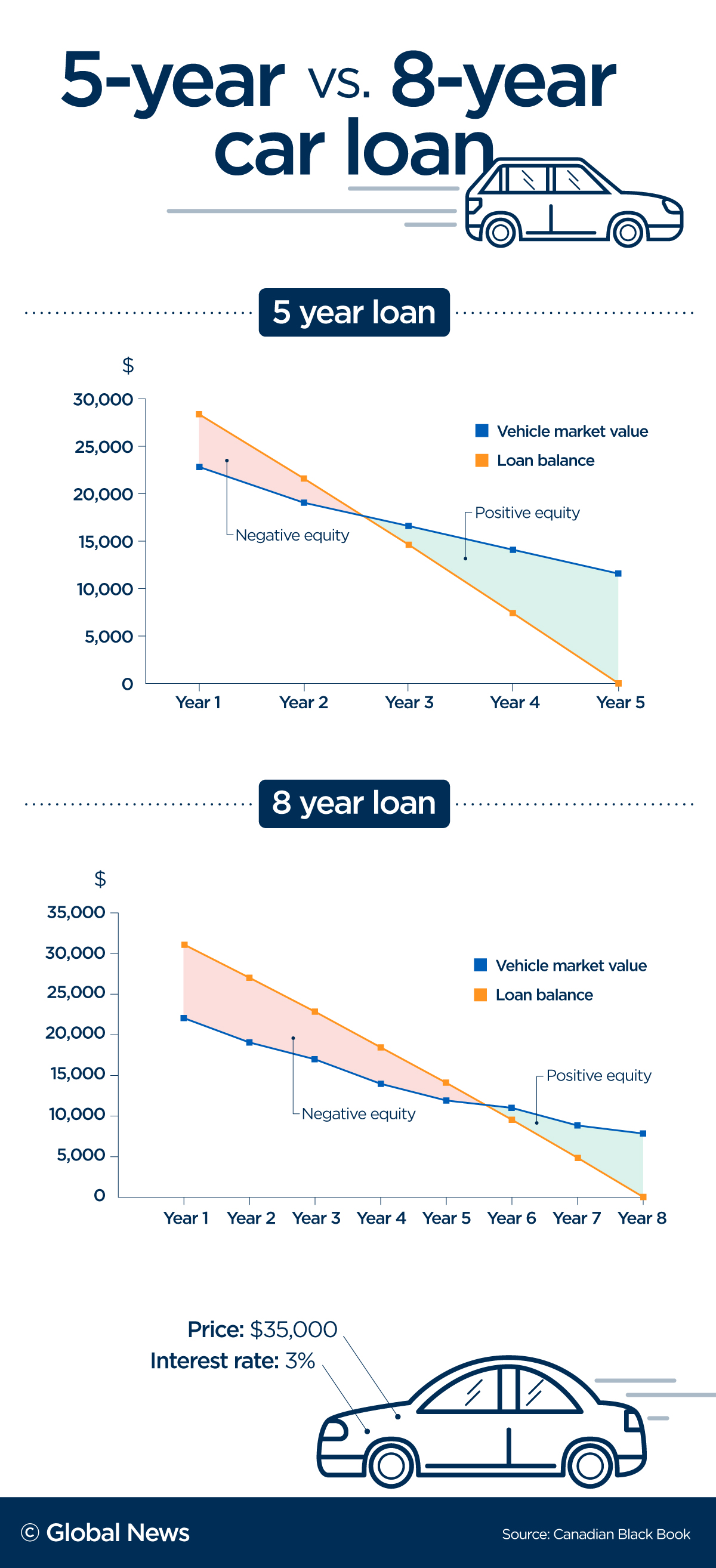

Yes Buying A New Car Makes More Sense Than Buying Used Wealthtender

0 Response to "Can I Change My Car Loan Term Malaysia"

Post a Comment